- QUICKBOOKS 2013 PAYROLL SUPPORT SOFTWARE DOWNLOAD

- QUICKBOOKS 2013 PAYROLL SUPPORT PRO

- QUICKBOOKS 2013 PAYROLL SUPPORT PLUS

Payroll and other online features and services requires Internet access with at least a 56 Kbps connection speed (DSL or cable modem recommended). Adobe Acrobat Reader: Business Planner functionality and viewing forms requires Adobe Acrobat Reader 5.0 or later.

QUICKBOOKS 2013 PAYROLL SUPPORT PLUS

O’Reilly members experience live online training, plus books, videos, and digital content from 200+ publishers. QuickBooks Point of Sale 2013 (V11.0), V10.0, V9.0, and V8.0. Get QuickBooks 2013 For Dummies now with O’Reilly online learning. You can preview any employee’s payroll data by clicking his or her name in the Review and Create Paychecks window. Though you can use QuickBooks functions entirely from the. QuickBooks calculates employee gross wages, deductions, and net wages, and the calculations appear in the Review and Create Paychecks window. Figure 1: QuickBooks myriad tutorials help you absorb the basics of processes like Payroll. Students will generate reports and utilize forms. When the Enter Payroll Income window correctly lists which employees should be paid, click Continue. The payroll focus will be personnel records, payroll calculations, and accounting for all payroll taxes. Initially, all the listed employees have a check mark beside their names, but you can click to remove a check mark and to remove an employee from the scheduled payroll. QuickBooks displays Enter Payroll Income window, which lists the employees who participate in the scheduled payroll. Then click the Start Scheduled Payroll button. (The Payroll Center window also shows any payroll tax liabilities that you accrued because of past payroll activity.) Select the scheduled payroll you want to, well, do. This Payroll Getting Started and Reference Guide will help. The Payroll Center window identifies any payroll schedules you set up. Its important to us that you are completely satisfied with QuickBooks Accounting software. QuickBooks displays the Employee Center: Payroll Center window.

Start the payroll process by choosing Employees⇒ Pay Employees⇒ Scheduled Payroll.

The process makes your whole decision to use QuickBooks to do your payroll worthwhile. App integration with QuickBooks POS 12.0, 18.

QUICKBOOKS 2013 PAYROLL SUPPORT SOFTWARE DOWNLOAD

QuickBooks Canada 2013 has two main software download products.

QUICKBOOKS 2013 PAYROLL SUPPORT PRO

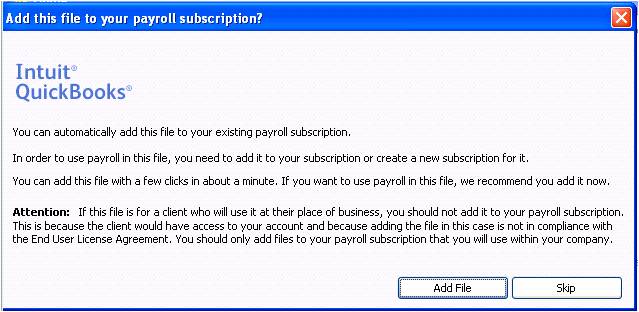

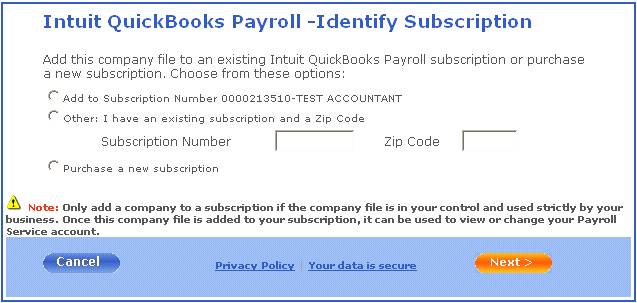

This section is going to blow your mind, especially if you’ve been doing payroll manually. Pro Plus is a 1-year subscription and includes unlimited customer support, automated data backup and recovery and easy access to the latest version, with the latest features and security patches. Microsoft Word and Excel integration requires Office 2013-2019, or Microsoft 365 (32 and 64 bit) Email Estimates, Invoices and other forms with Microsoft Outlook 2013-2019, Microsoft 365, Gmail, and, or other SMTP-supporting email clients. QuickBooks Desktop Pro Plus with Enhanced Payroll 2022 1-Year Subscription for 1 User. After you subscribe to the QuickBooks Payroll service and set up your payroll schedule, you’re ready to pay someone.

0 kommentar(er)

0 kommentar(er)